Trying to navigate the digital marketing landscape can be daunting, and credit unions seeking to navigate the digital marketing landscape can find themselves overwhelmed by all that’s out there. This blog post will provide guidance that will help you get started by addressing the following:

- Defining an audience and setting goals

- Minimizing wasted ad spend

- Which platforms to utilize. Don’t stretch yourself thin by being everywhere. Concentrate efforts on critical platforms and achieve consistency and success before expanding.

Defining an Audience and Setting Goals

When we get started with a new credit union client, we work with them to establish a target audience. In many cases, we’ll get different input on the makeup of the target audience as we get information from the stakeholders. We’ll take that input with data we get from sources like Google Analytics and Facebook, which help us understand the makeup of the people who come to the site, interact with it and execute desired actions. Those last three things are essential to map out because of differences between individuals who go to your website and leave, those who browse and those who become a member. There will be more on that in another post.

Once you define your audience(s), you’ll need to create goals (or, the desired outcomes). These can range from newsletter subscriptions and financial calculator interactions to a call to set up an appointment or submission of a loan application. Two reasons to do this:

- If you define it, you’ll track it and optimize it. Create segments and audiences in Google Analytics to better track channel and campaign performance and use the data to refine strategies.

- Smaller interactions (e.g., newsletter subscriptions, financial calculators, etc.) can lead to the big ones (e.g., set up an appointment, loan application submission). Categorize these as micro and macro conversions. Track these, and you’ll be able to tell how the micro-conversions lead to the macro — more on this in a future post.

Minimizing Wasted Ad Spend

One of our core operating values is that we should prove ourselves with the small stuff if we want the big stuff. To that end, if you maximize the returns on a small ad budget, you’ll likely get a bigger budget down the road. One problem we see is that credit unions want to be active in many digital ad channels despite small budgets. Doing so dilutes the budget and prevents optimal performance. So, pick your channels based on the best potential outcomes and then grow from there.

When given a limited budget, we tend to focus on paid search and display. The Google Ads platform gives you access to both of these channels, and more. Assuming you start on the Google Ads platform, here are some pointers to minimize wasted ad spend:

- Negative keywords: this is as important as the core keyword list you build. Putting in negative keywords allows you to focus your efforts on the terms/phrases that produce desired outcomes. Read this post for more on this topic.

- Negative placements: this is like negative keywords, but for display placements. Some sites don’t produce quality clicks, and you don’t want to waste your money on that. Look for placements with low impressions and high CTRs, click farm sites, parked domains, and sites that you don’t want your brand to appear on.

- Demographic targeting: depending on your target audience, you might not want to target specific age groups or household incomes. For example, if you’re promoting a CD special, then you probably don’t want to target a younger audience. So, focus your efforts on the ideal age range.

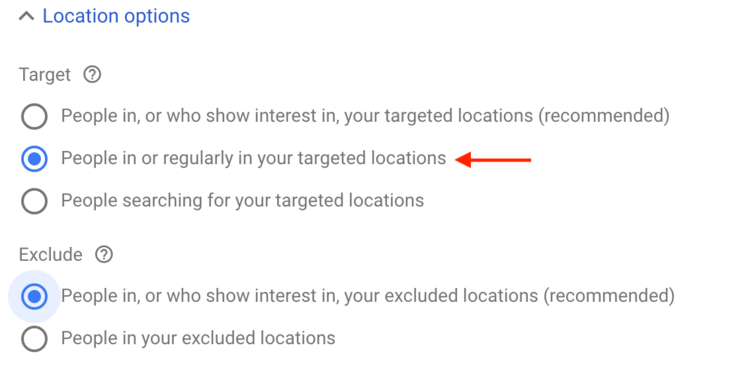

- Location settings: when you set your geographic targets, we suggest taking one extra step to avoid spending in places you don’t want to spend. Go to Location Options and under Target choose People in or regularly in your targeted locations (see below).

Which Digital Marketing Platforms to Utilize

Which platforms to utilize isn’t a clear cut answer for every credit union, but, as stated above, we tend to start credit union clients who are new to digital marketing with the Google Ads platform (search and display) and grow from there. It’s essential to build a foundation that allows you to increase your digital marketing program, and Google Ads is a solid starting point. There’s so much that can be done on that platform, and the integration with Google Analytics allows for scale. When you get a bigger marketing budget, you can leverage learnings (gained from data analysis) to broaden reach and do some testing to identify new growth opportunities.

In a nutshell, don’t get overly aggressive and dilute a small budget. Focus on building a foundation for growth, build up some wins, and use that to justify getting a bigger marketing budget.

If you have specific questions or comments, post them in the comment section below so others in your shoes can learn and benefit.